Back

3 Feb 2022

Crude Oil Futures: Room for extra correction

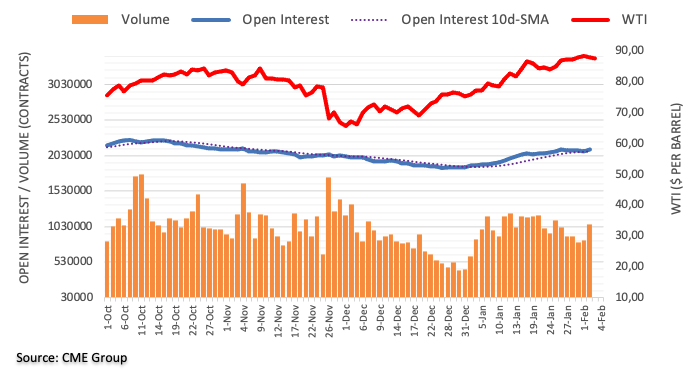

CME Group’s preliminary readings for crude oil futures markets saw traders adding around 24.6K contracts to their open interest positions on Wednesday. Volume followed suit and increased for the second session in a row, this time by nearly 225K contracts, the largest single-day build since January 11.

WTI appears limited near $90.00

Prices of the WTI clinched new tops just below the $90.00 mark per barrel on Wednesday before ending the session with modest losses. The daily downtick was amidst rising open interest and volume, which is supportive of further retracement in the very near term. Collaborating with this view, the commodity navigates the boundaries of the overbought conditions.