EUR/USD Price Analysis: Bulls need to cross 1.2060 to keep the reins

- EUR/USD stays on the front foot, recently inactive, near seven-week top.

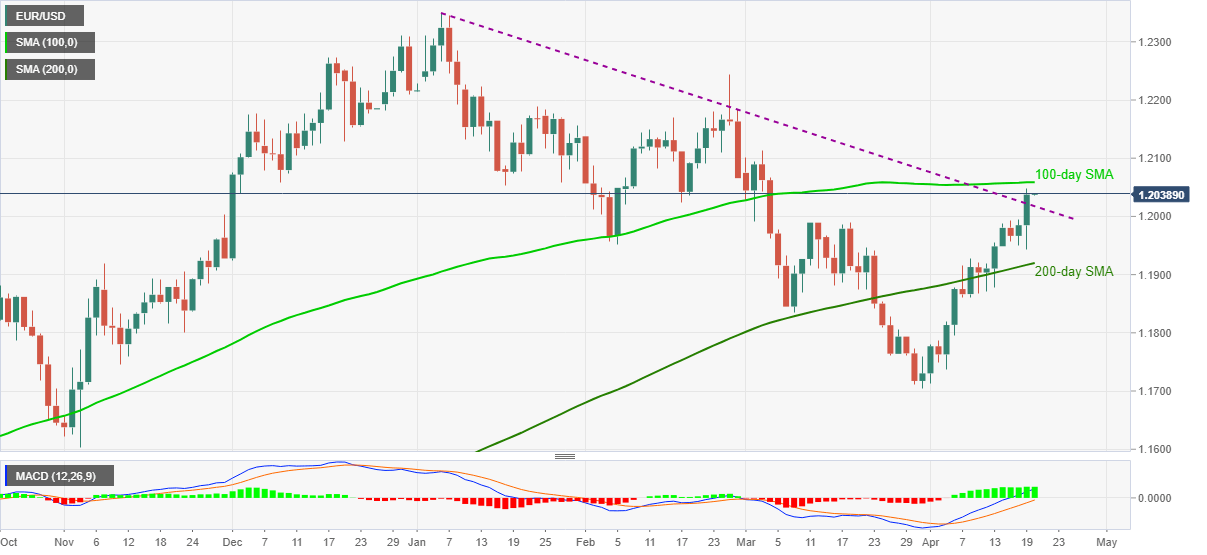

- 100-day SMA tests the upside break of the key resistance line, now support.

- Bullish MACD, sustained trading above 200-day SMA favor buyers.

EUR/USD buyers catch a breather around 1.2040, after rising the most in two weeks, during Tuesday’s Asian session. In doing so, the quote keeps the previous day’s upside break of a descending trend line from January 06, also staying above the 200-day SMA, amid the bullish MACD signals.

However, 100-day SMA around 1.2060 tests the major currency pair’s latest run-up, a break of which will highlight March’s top of 1.2133 and late January peak surrounding 1.2190 for the EUR/USD bulls.

Given the strong MACD signals and the quote’s ability to trade successfully beyond 200-day SMA, EUR/USD prices are likely to remain firm before hitting February’s top near 1.2245.

Alternatively, pullback moves below the immediate support line, previous resistance, surrounding 1.2015 will recall the mid-March tops near 1.1990 to the chart.

However, EUR/USD sellers are less expected to take fresh entries until witnessing a daily closing below the 200-day SMA level of 1.1920.

EUR/USD daily chart

Trend: Bullish