GBP/USD Price Analysis: Bulls target a significant retracement of bearish daily impulse

- GBP/USD is o the verge of an upside correction from the daily demand area.

- Bulls can looking to the lower time frames, such as the 15-min, to establish an optimal entry point.

Cable has been in the hands of the bears midweek as the US dollar firms on a safe-haven bid.

The following is an analysis of the market structure from both a daily and a 15-min perspective.

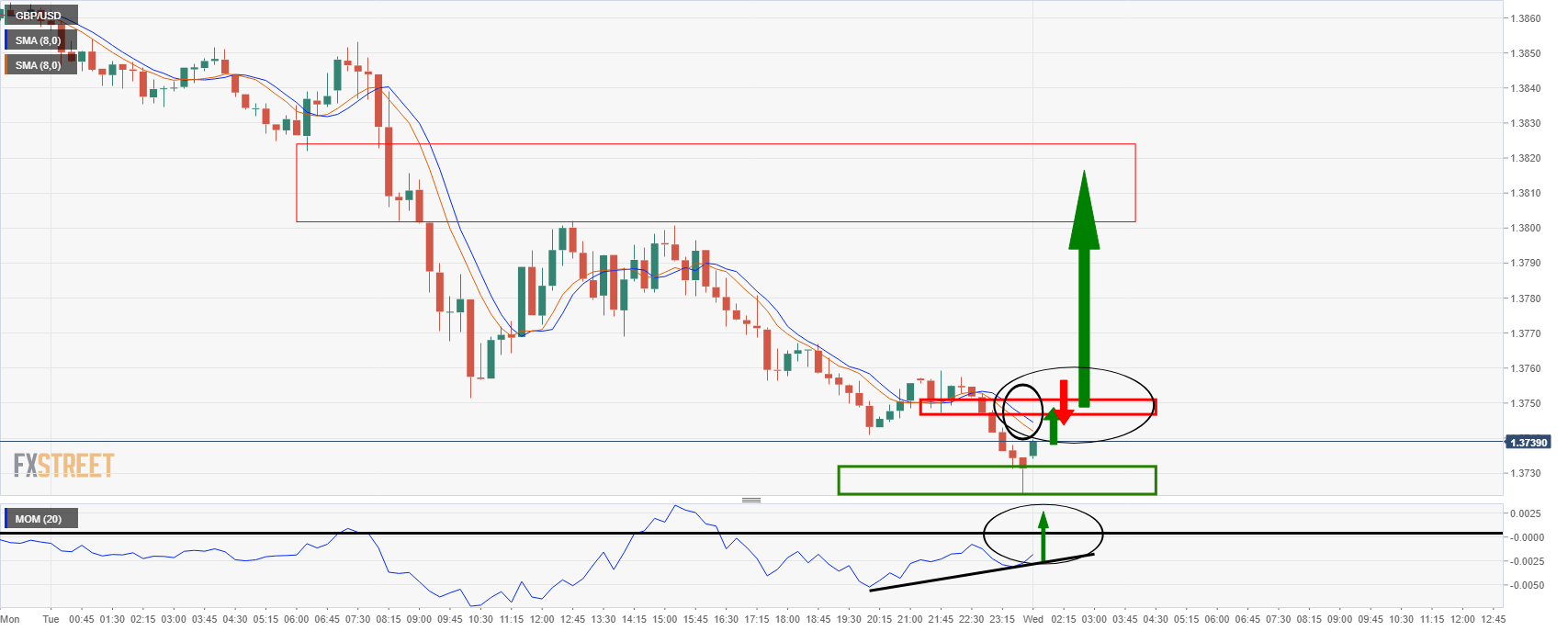

The 15 min chart can be used as a vantage point from which to gauge for a bullish environment and for long-entry point conditions.

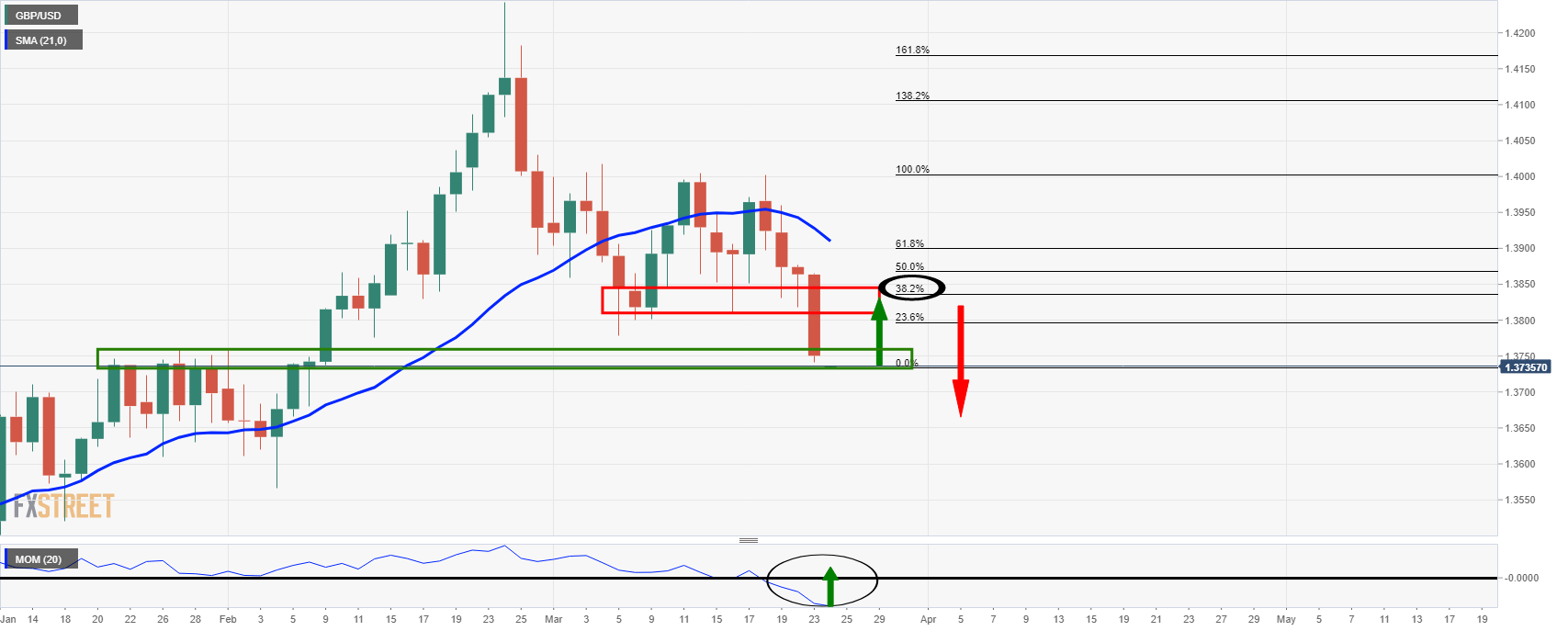

GBP/USD daily chart

As can be seen, the price is bearish below the 21-day SMA and Momentum in negative territory.

However, while a downside continuation can be expected, a meanwhile correction could be on the cards from which point bears will seek a discount to reengage and take on the daily support again.

From a 15-min perspective, there could be an opportunity in the making on a break above the immediate resistance structure.

The 8 open vs 8 close SMA will confirm a bullish bias on the bullish cross over to trigger an long-entry-point window as soon as Momentum confirms by moving over the zero line.