Back

15 Mar 2021

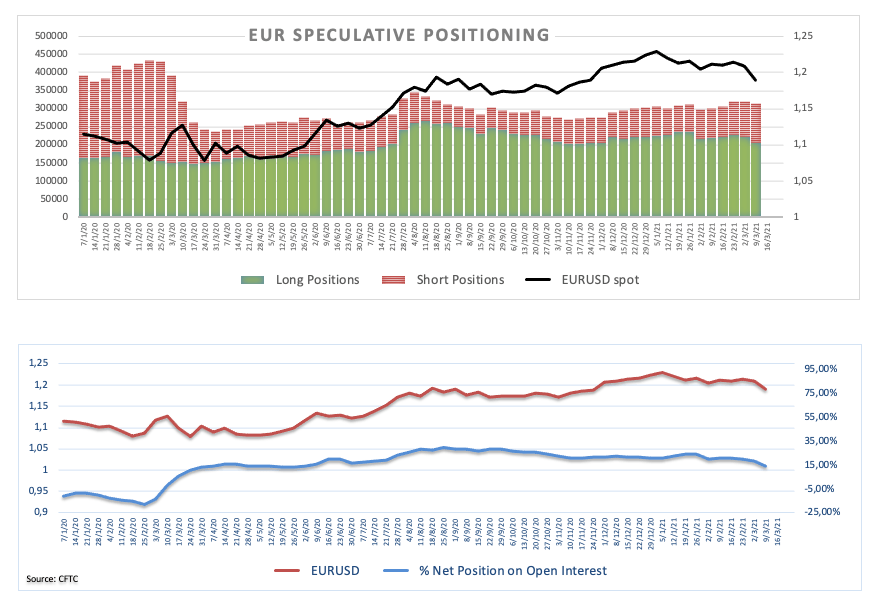

CFTC Positioning Report: EUR net longs dropped to multi-month lows

These are the main highlights of the CFTC Positioning Report for the week ended on March 9th:

- Net longs in EUR retreated to levels last seen in late June 2020. Investors scaled back their gross longs in response to the perception that the economic recovery in the euro bloc might face unexpected and tougher headwinds than previously anticipated in the next months. In addition, it seems speculators positioned for a dovish message from the ECB at its meeting past the cut-off date.

- Speculators trimmed further the net shorts in the USD to levels last observed in early December 2020. The reflation/vaccine/inflation trade continues to support the greenback in a context of increased resilience in spot and US yields climbing to levels last seen over a year ago.

- The path higher in US yields also added to the selling pressure in the Japanese JPY, with gross shorts uninterruptedly increasing since mid-January and taking net longs to around 6.5K contracts, the lowest level so far this year.

- The solid rally in crude oil prices pushed net longs in the commodity to the highest level since the summer 2020. The recent steady stance from the OPEC+, expected increased demand in the next months pari passu with rising bets of a strong global recovery all add to the rosy picture around crude oil.