US Dollar Index looks firmer and targets 92.00

- The dollar adds to Friday’s gains well above the 91.00 level.

- Yields of the US 10-year reference trade beyond 1.60%.

- NY Empire State Index, TIC Flows next in the calendar.

The greenback opens the week on the positive footing and motivates the US Dollar index (DXY) to extend the rebound to the proximity of 91.90.

US Dollar Index up on higher yields, looks to data

The index advances for the second session in a row on Monday, although a test of the key barrier at 92.00 the figure still remains elusive for USD-bulls.

The pick-up in US yields to levels last seen over a year ago near the 1.65% level sustains the continuation of the leg higher in the buck, which keep targeting recent yearly highs in the mid-92.00s.

The index, in the meantime, remains well underpinned by the narrative around the US economy outperformance vs. its overseas peers, in turn propped up by the solid pace of the vaccine rollout (again vs. its G10 counterparts).

Later in the US docket, the NY Empire State Index is due seconded by TIC Flows.

What to look for around USD

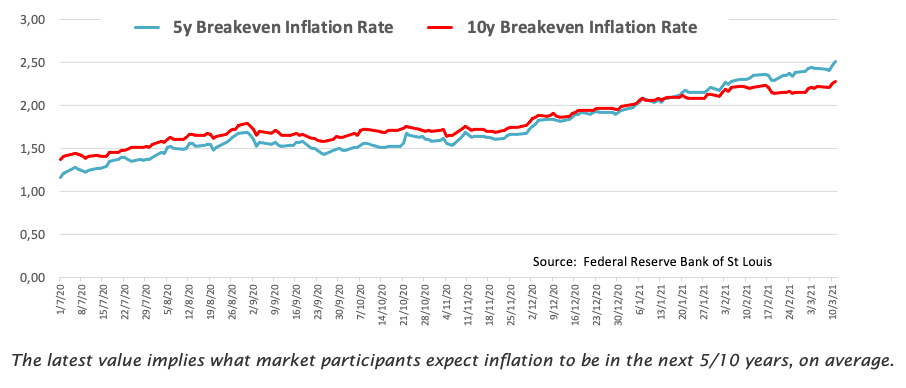

The change of heart in the buck seen in past weeks remains underpinned by the expected better performance of the US economy vs. its G10 peers. The fresh stimulus aid is also seen adding to the latter pari passu with the investors’ perception of higher inflation in the months to come and its translation into rising US yields. However, a sustainable move higher in DXY should be taken with a pinch of salt amidst the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery.

Key events in the US this week: Retail Sales/Industrial Production (Tuesday) – FOMC event (Wednesday) – Initial Claims/Philly Fed Index (Thursday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.14% at 91.81 and a breakout of 92.50 (2021 high Mar.9) would expose 92.77 (200-day SMA) and finally 94.30 (monthly high Nov.4). On the other hand, the next support emerges at 91.36 (weekly low Mar.11) seconded by 91.05 (high Feb.17) and then 90.70 (50-day SMA).