Back

14 May 2020

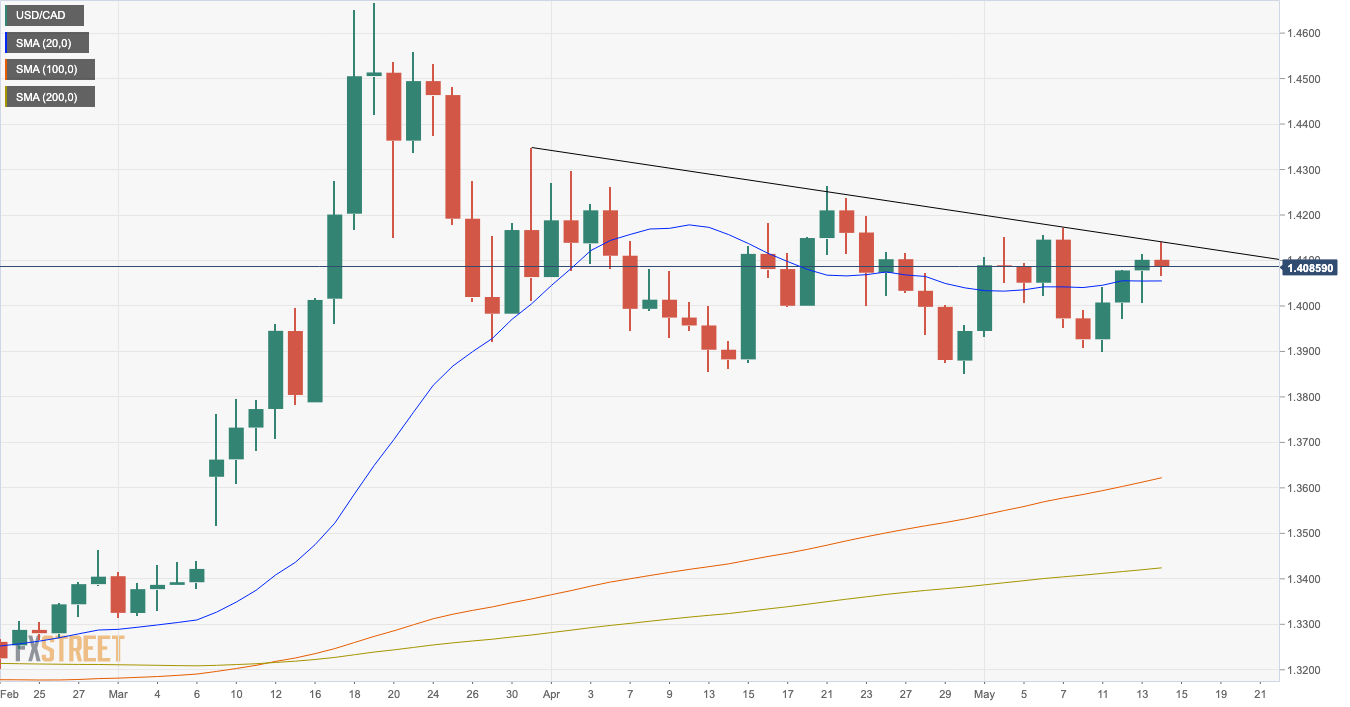

USD/CAD Price Analysis: dollar rally capped by trendline resistance at 1.4140

- USD/CAD’s three-day rally from 1.3900 has been capped by downtrend resistance at 1.4140

- The pair remains bullish on daily charts, supported by the 20-day SMA at 1.4065.

- Above 1.4140, next resistance levels would be 1.4175 and 1.4265.

This week’s US dollar rally from 1.3900 has stalled today at 1.4140 and the pair has retreated below 1.4100, turning negative on the day. The USD/CAD, however, remains steady above the main moving average lines, with the 20-day SMA offering support at 1.4065 so far.

The daily chart shows the pair limited below the downward trending resistance line from March 31 highs at 1.4140. A successful break beyond this line would increase bullish pressure on the USD, to target May 7 high at 1.4175 and March 21 high at 14265.

On the downside, below the 20-day SMA at 1.4055, the pair might target 1.3900 (May 11 low) and 1.3855 (April 30 low).

USD/CAD daily chart

USD/CAD key levels to watch