Back

14 Feb 2020

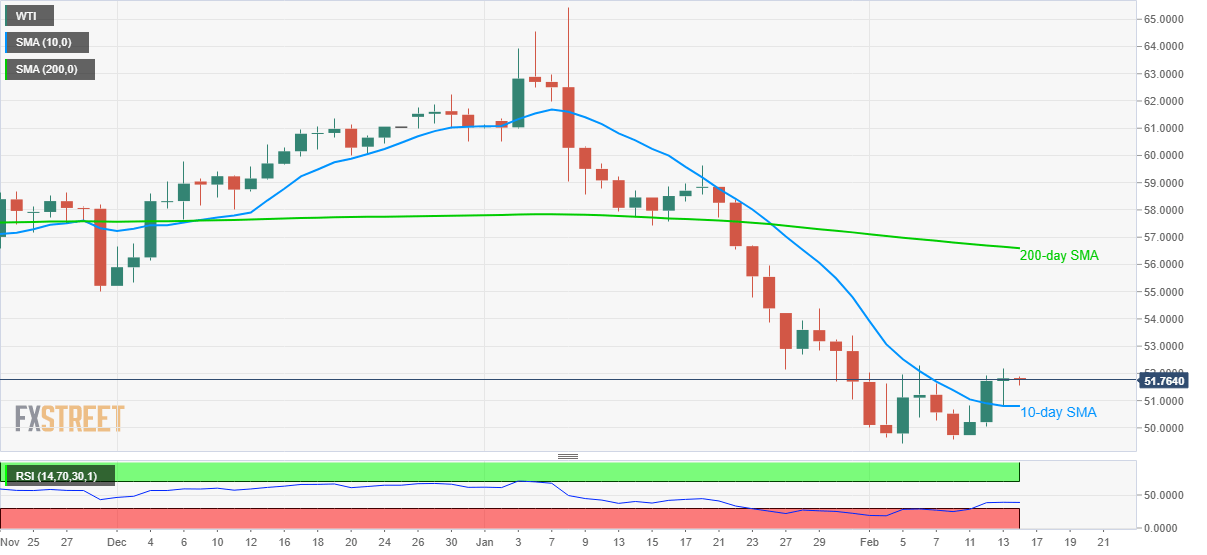

WTI Price Analysis: Sustained break of 10-day SMA keeps buyers hopeful

- WTI consolidates recent gains.

- Oversold RSI conditions, sustained break of short-term SMA favor buyers.

- 200-day SMA keeps being a tough nut to crack for the bulls.

WTI steps back to $51.72 while heading into the European session on Friday. the oil benchmark crossed 10-day SMA for the first time since early January on Wednesday and has been above that afterward. Also supporting the bullish sentiment is oversold RSI conditions.

As a result, buyers can take aim on January 29 to surrounding $54.38 whereas November 2019 low near $55.00 could challenge the upside then after.

If at all the oil prices remain on the front foot past-$55, a 200-day SMA level around $56.60 will be in the spotlight.

Meanwhile, the black gold’s declines below 10-day SMA level of $50.80 can take rest at the latest lows, also the multi-year low, near $49.40.

WTI daily chart

Trend: Recovery expected