NZD/USD Technical Analysis: On the front foot despite soft China data

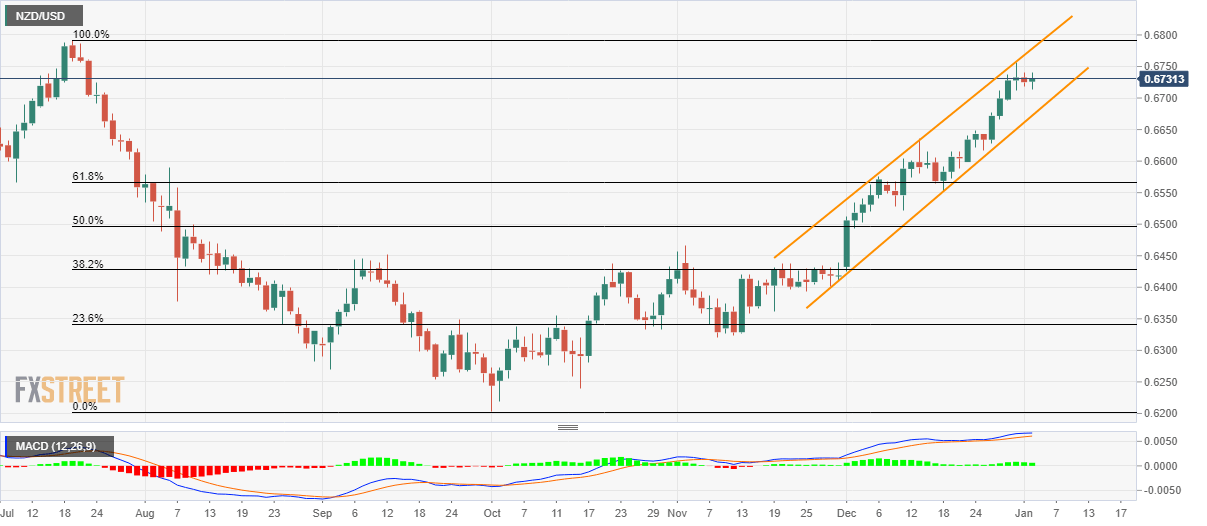

- NZD/USD remains inside the short-term rising channel even if China’s Caixin Manufacturing PMI came in weaker than expected in December.

- July month high acts as immediate upside barrier whereas 61.8% Fibonacci retracement adds to the support.

NZD/USD stays mostly firm around 0.6730 amid the initial trading session on Thursday. The pair recently ignored downbeat manufacturing data from China while keeping then near-term bullish technical formation.

China’s December month Caixin Manufacturing PMI came in at 51.5 from 51.7 expected and 51.8 prior. However, the private manufacturing gauge still stood beyond 50 level for the fifth time in a raw.

As a result, prices are likely to head towards July month high of 0.6792 and then to 0.6800 round-figure during further upside. Even so, the week’s high near 0.6756 and the channel’s upper-line at 0.6775 can offer nearby resistances to the pair.

On the flip side, sellers will look for entry below the one-month-old rising channel’s support, at 0.6670 now.

In doing so, their target will be 61.8% Fibonacci retracement of July-October fall, at 0.6566. Though, August month high near 0.6590 can be considered as an intermediate halt during the declines.

NZD/USD daily chart

Trend: Bullish