Back

29 Nov 2019

US Dollar Index Technical Analysis: Failed breakout above the critical 98.50 resistance

- DXY retreats after hitting fresh November highs.

- A correction seems underway. Support is seen at the 98.20 level and 98.00 handle.

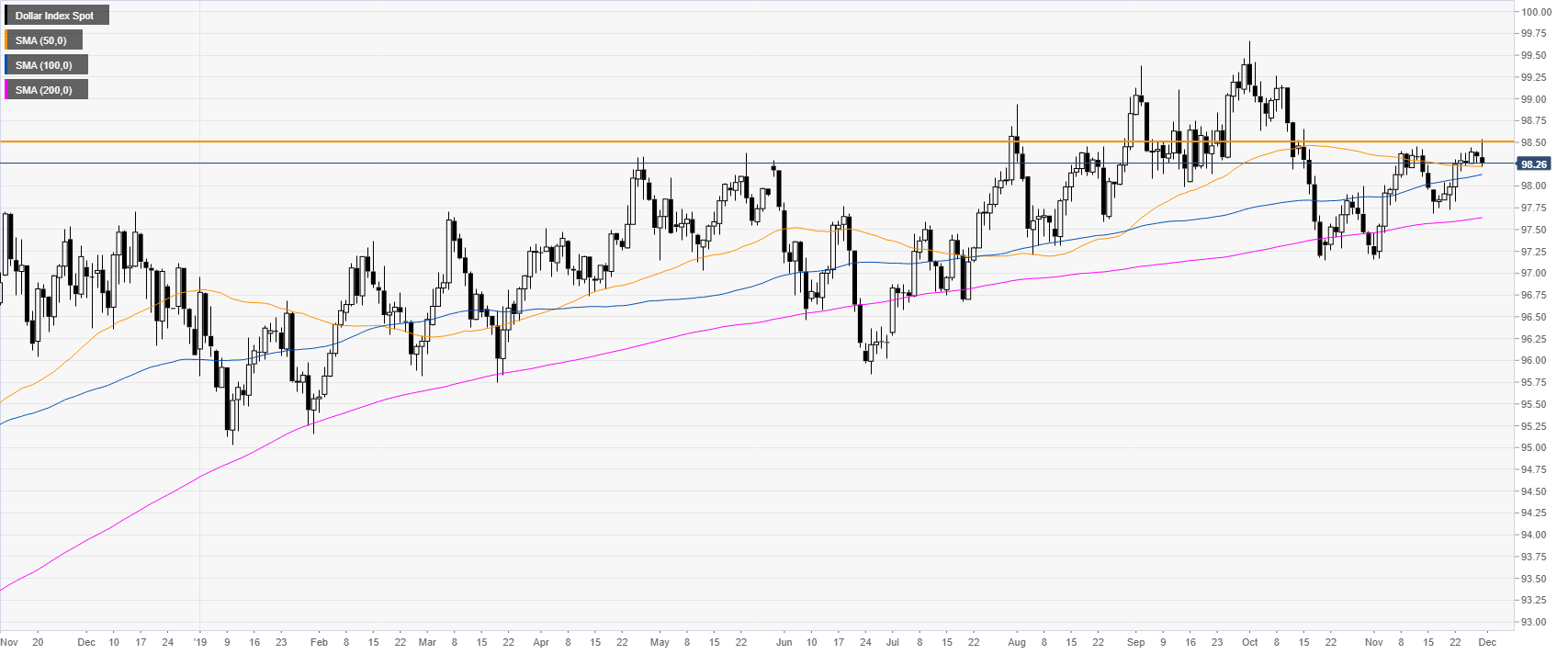

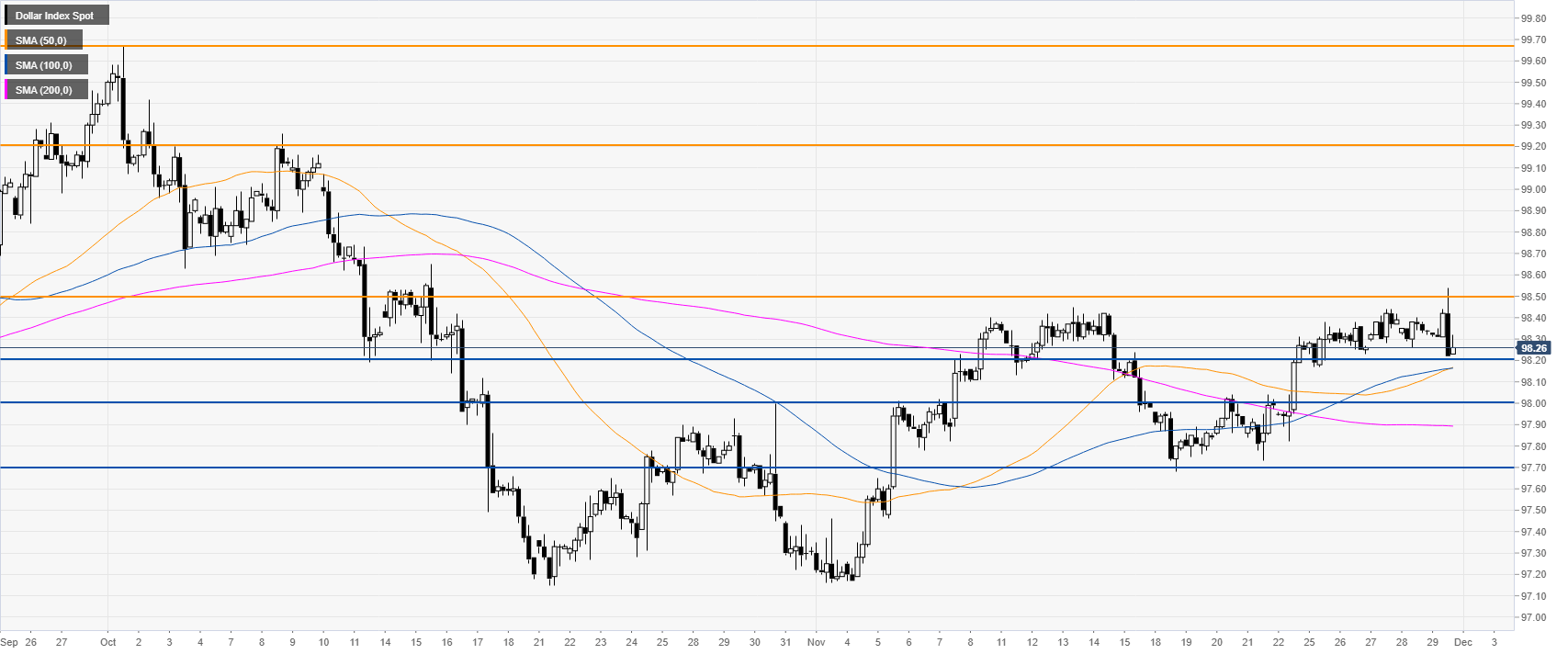

DXY daily chart

DXY (US Dollar Index) is trading in a bull trend above the main daily simple moving averages (DMAs). However, this Friday, the greenback had a failed breakout above the 98.50 resistance.

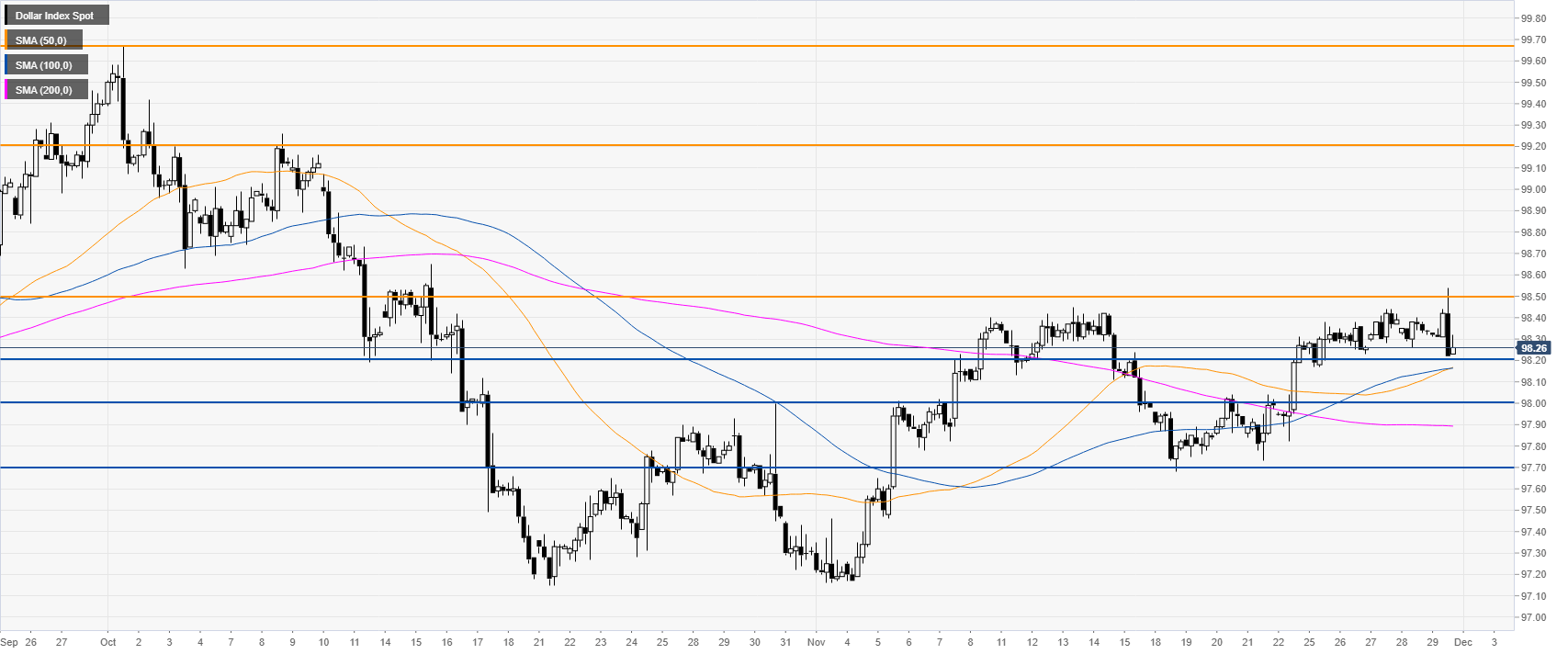

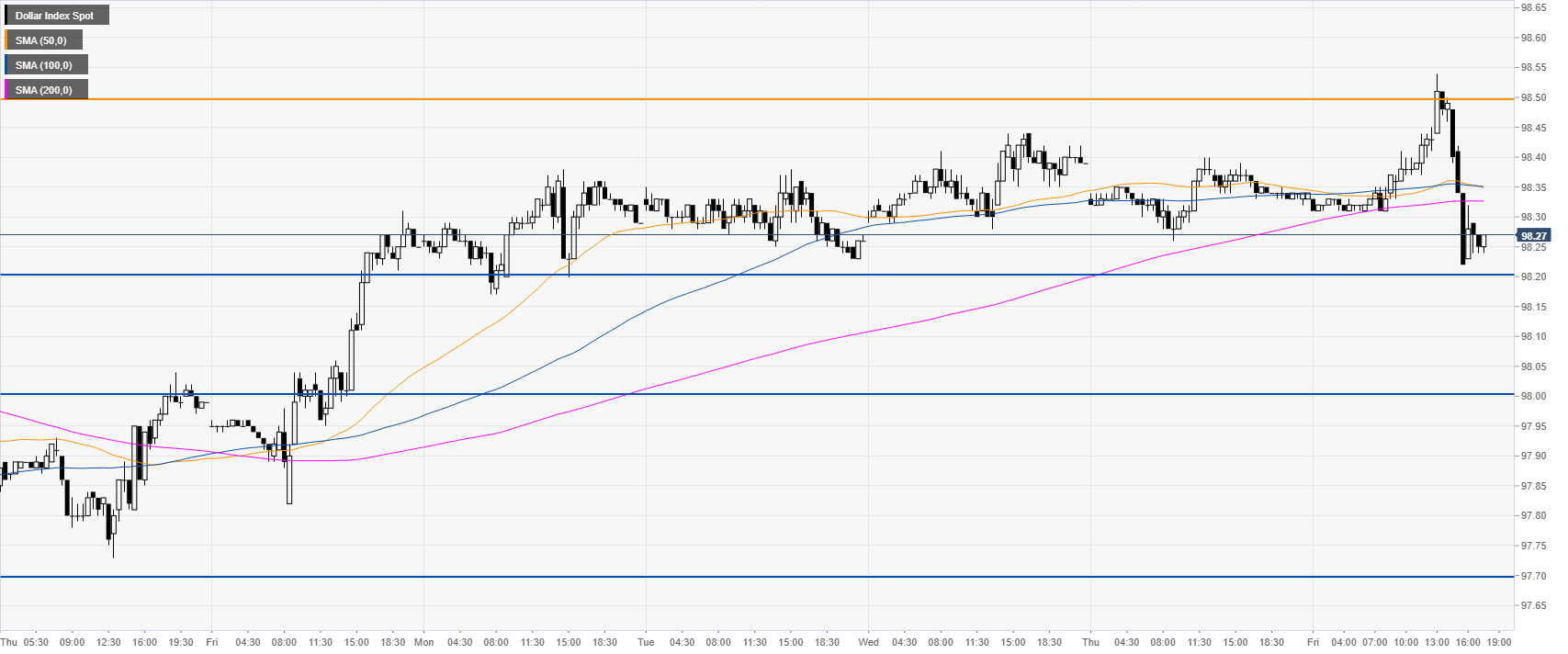

DXY four-hour chart

DXY is trending up above the main SMAs on the four-hour chart. However, the market rejected a critical resistance at the 98.50 level after hitting fresh November highs. To continue the uptrend, bulls must have a daily close above the 98.50 level to reach 99.20 level and the 99.67 level (2019 high).

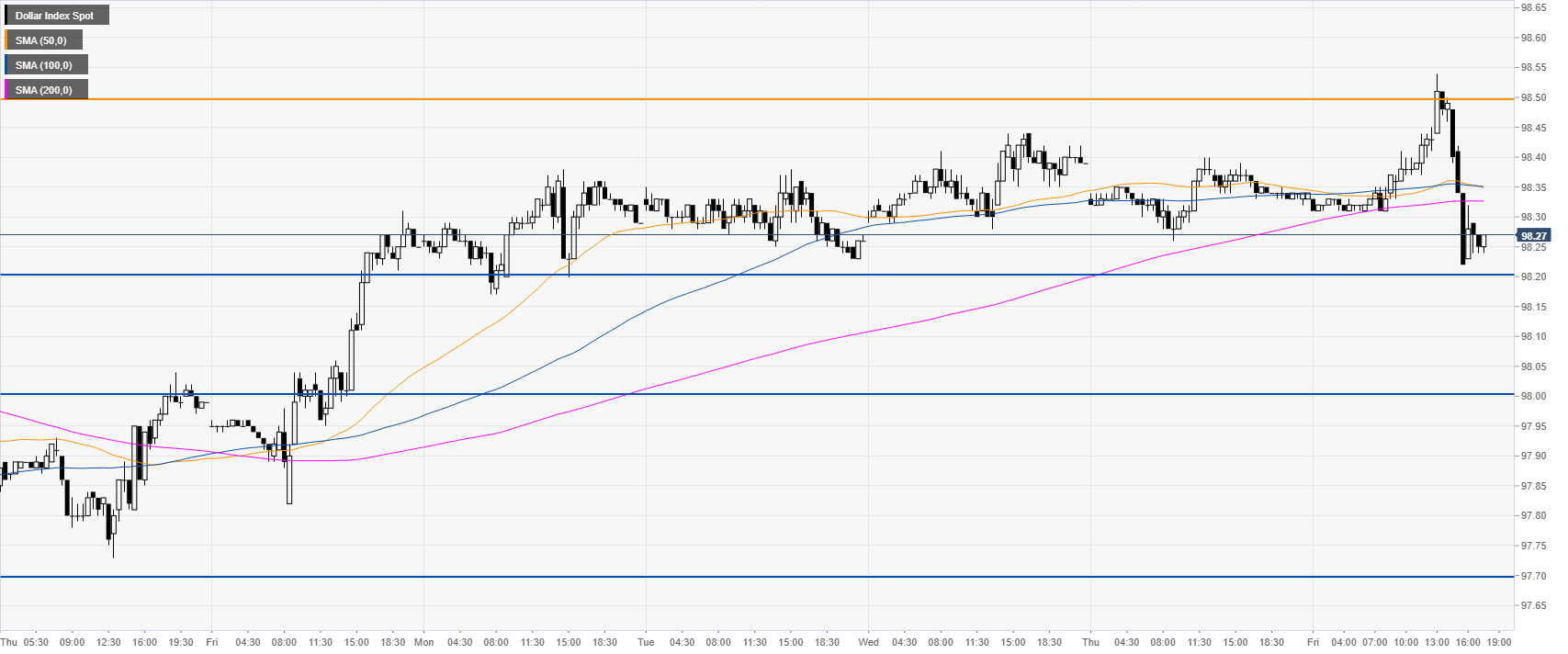

DXY 30-minute chart

The greenback dropped below its main SMAs, suggesting a bearish momentum in the near term. A break below the 98.20 level can expose the 98.00 handle.

Additional key levels