Back

31 Jan 2019

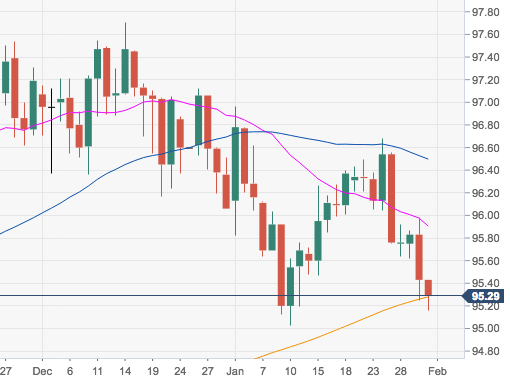

US Dollar Index Technical Analysis: A break below the 200-day SMA at 95.29 could prompt a deeper pullback

- The greenback sold off post-FOMC on Wednesday and is now holding on to the critical 200-day SMA in the 95.30/25 band.

- This region is reinforced by the proximity of the 61.8% Fibo retracement of the September-December up move at 95.30.

- A lost of this key area should open the door for a potential retracement to YTD lows in the 95.00 neighbourhood.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 95.28

Today Daily change: -0.15 pips

Today Daily change %: -0.16%

Today Daily Open: 95.43

Trends:

Daily SMA20: 95.94

Daily SMA50: 96.51

Daily SMA100: 96.13

Daily SMA200: 95.26

Levels:

Previous Daily High: 95.98

Previous Daily Low: 95.25

Previous Weekly High: 96.68

Previous Weekly Low: 95.75

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 95.53

Daily Fibonacci 61.8%: 95.7

Daily Pivot Point S1: 95.13

Daily Pivot Point S2: 94.82

Daily Pivot Point S3: 94.4

Daily Pivot Point R1: 95.86

Daily Pivot Point R2: 96.28

Daily Pivot Point R3: 96.59