Back

18 Jan 2019

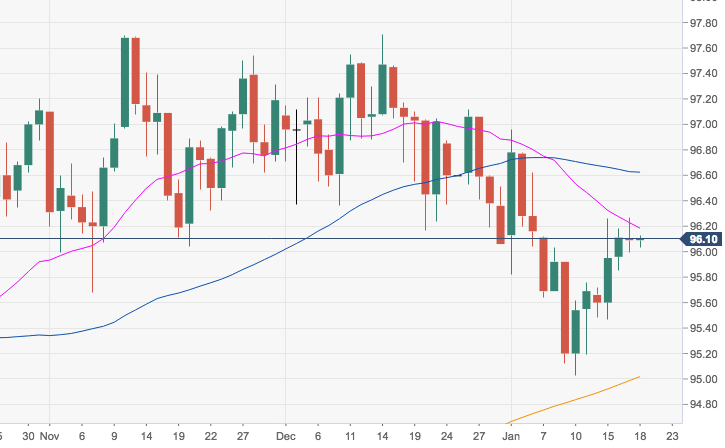

US Dollar Index Technical Analysis: The greenback still targets the 96.30 area and above

- The index is extending the rebound from last week’s lows and is once again facing important resistance in the 96.20/30 band.

- This area is supported by the 21-day SMA, today at 96.15, and the 38.2% Fibo retracement of the September-December up move, at 96.22.

- DXY has so far returned to the previous multi-week 95.70-97.70 range and extra gains should now retake the 96.60/80 band, where converge the 55-day SMA and another Fibo retracement.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.11

Today Daily change: 1 pips

Today Daily change %: 0.0208%

Today Daily Open: 96.09

Trends:

Daily SMA20: 96.19

Daily SMA50: 96.66

Daily SMA100: 96.05

Daily SMA200: 94.99

Levels:

Previous Daily High: 96.27

Previous Daily Low: 95.99

Previous Weekly High: 96.12

Previous Weekly Low: 95.03

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.1

Daily Fibonacci 61.8%: 96.16

Daily Pivot Point S1: 95.96

Daily Pivot Point S2: 95.84

Daily Pivot Point S3: 95.68

Daily Pivot Point R1: 96.24

Daily Pivot Point R2: 96.4

Daily Pivot Point R3: 96.52