EUR/USD Technical Analysis: Dropping into 1.1330 in the European pre-market

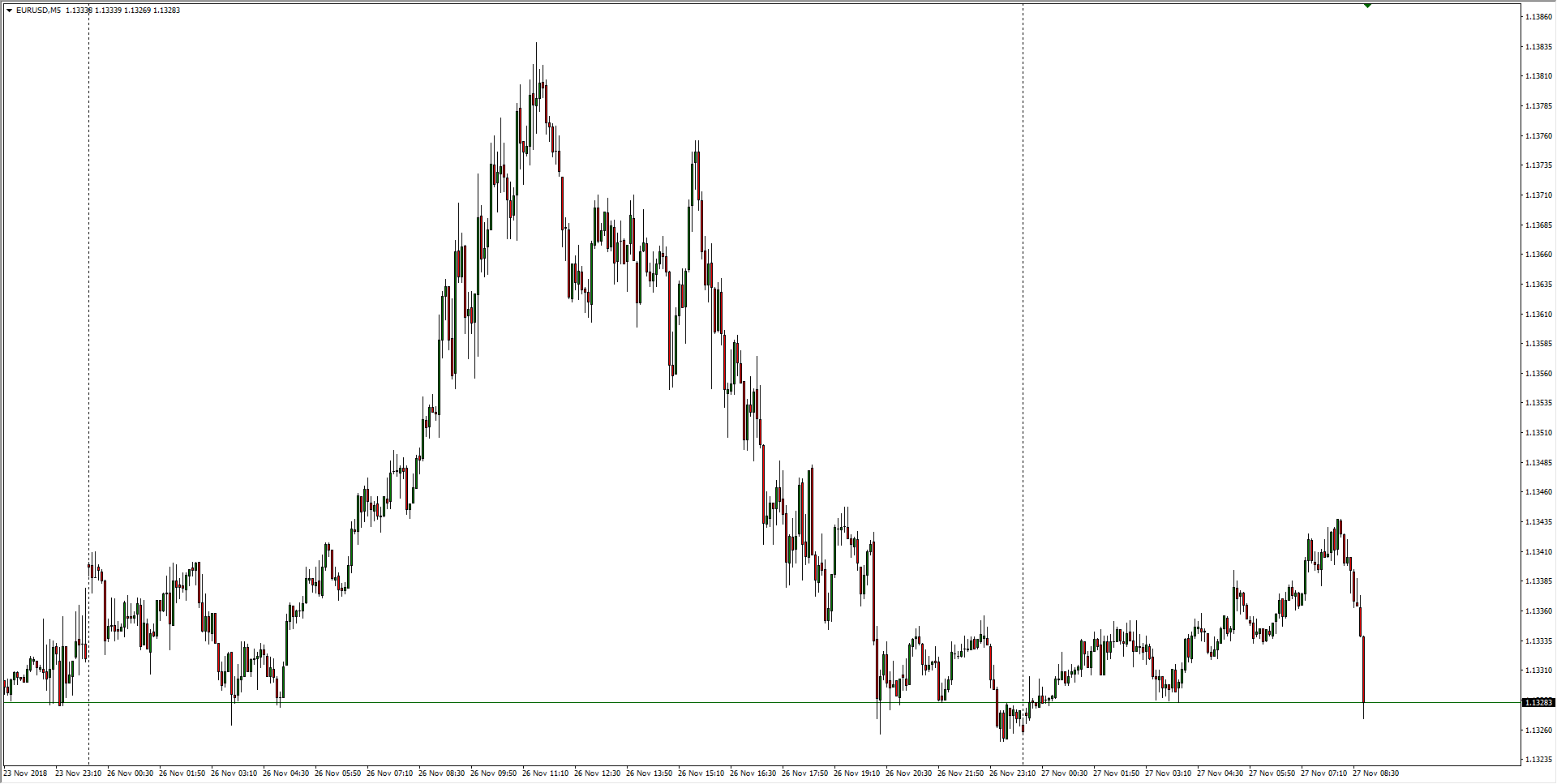

- The EUR/USD major pairing is looking at some quick selling heading into the European market session after a mild bid through Tuesday's early trading.

- The previous twenty-four hours saw the Euro pick up to the 1.1380 region before ducking back down to the week's open just above the 1.1300 barrier.

EUR/USD Chart, 5-Minute

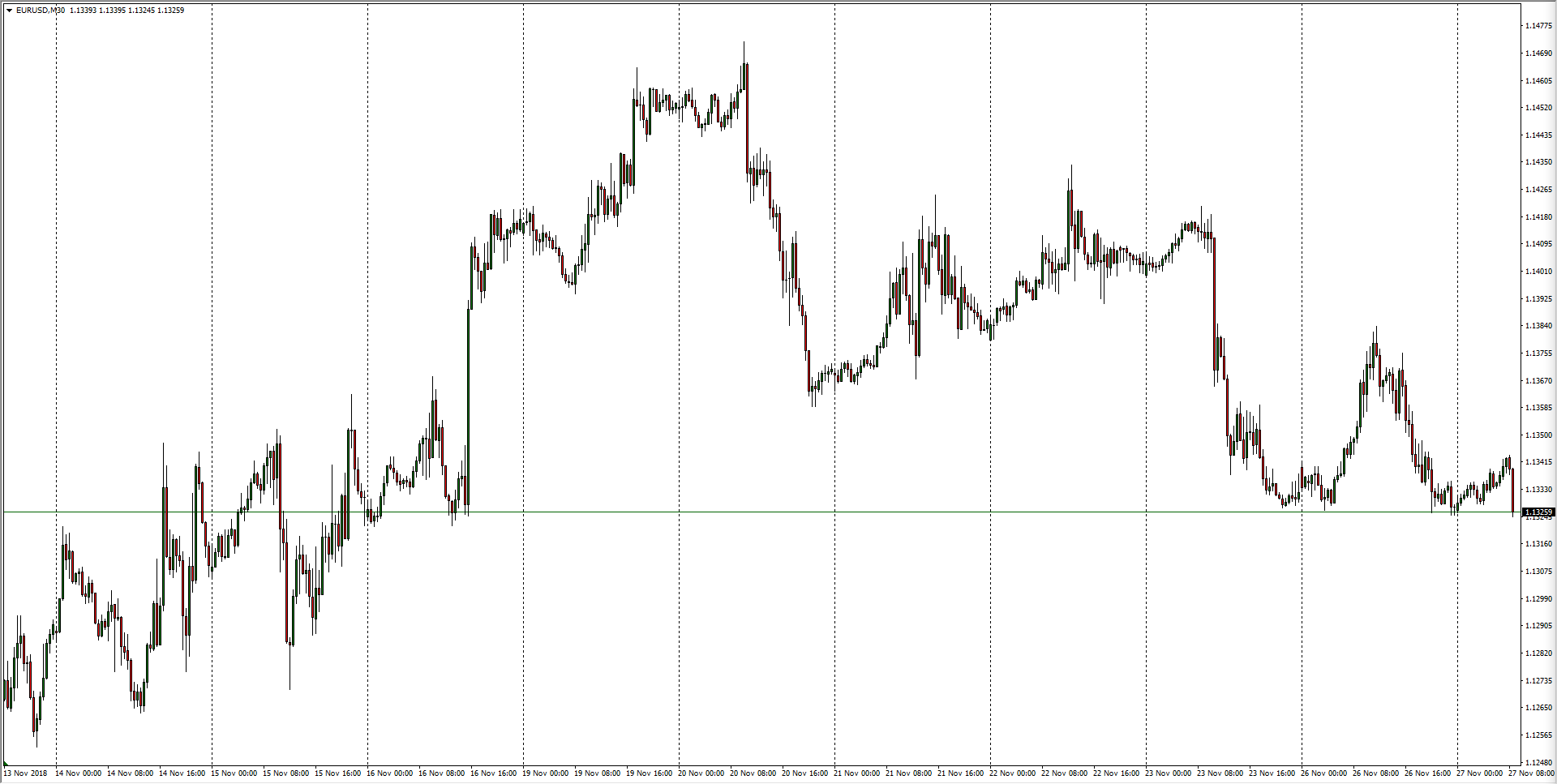

- Over the past two weeks the EUR/USD has begun to round out, and swing highs are beginning to see capping action as broader markets begin to swing bullish on the Greenback.

EUR/USD Chart, 30-Minute

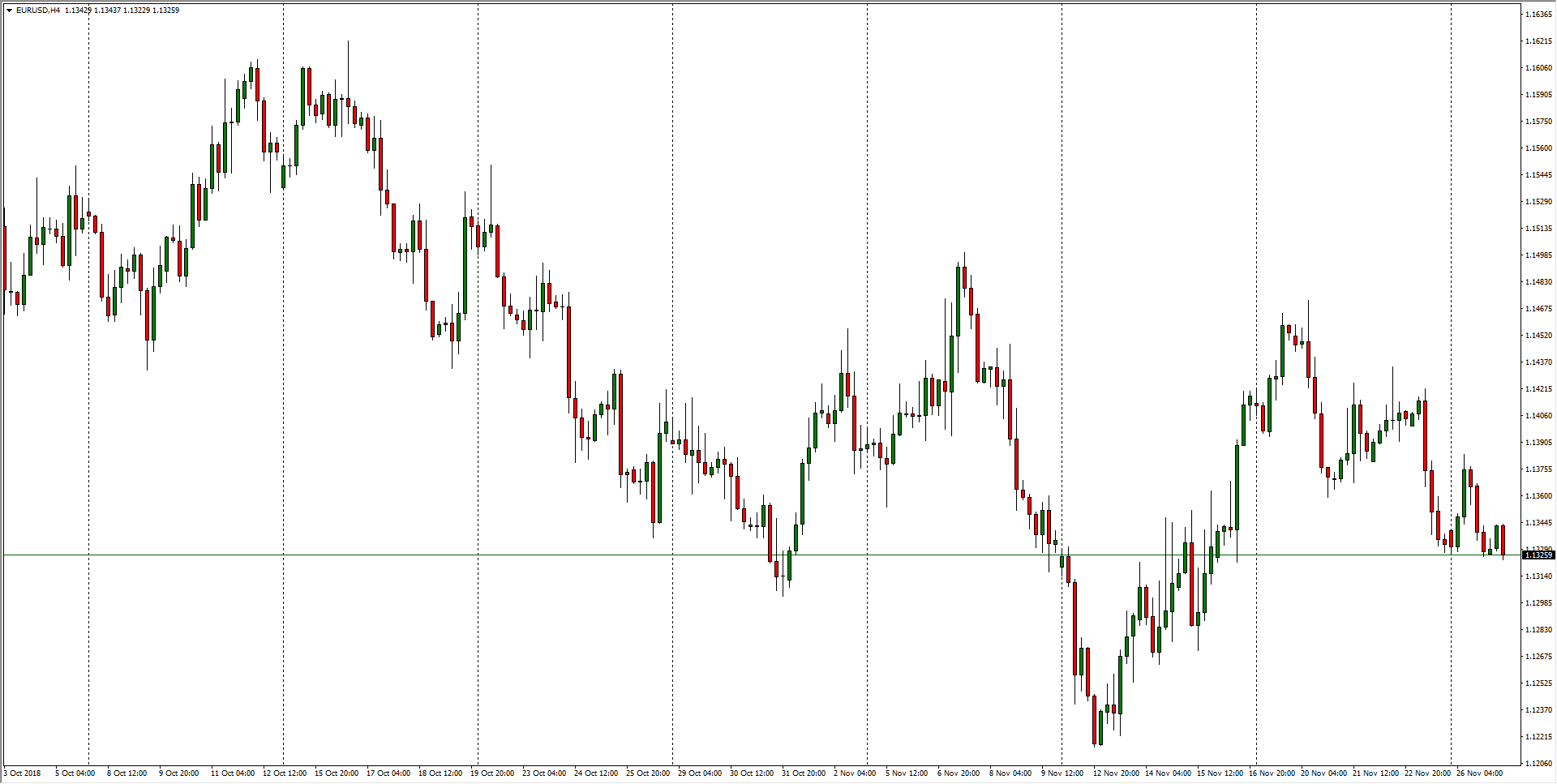

- The past two months shows the Fiber setting up for a bearish continuation in the mid-term, and the next leg down will see sellers targeting beyond the 1.1240 level.

EUR/USD Chart, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1334

Today Daily change: 0.0 pips

Today Daily change %: 0.00%

Today Daily Open: 1.1334

Trends:

Previous Daily SMA20: 1.1364

Previous Daily SMA50: 1.1481

Previous Daily SMA100: 1.1544

Previous Daily SMA200: 1.1785

Levels:

Previous Daily High: 1.1384

Previous Daily Low: 1.1326

Previous Weekly High: 1.1473

Previous Weekly Low: 1.1328

Previous Monthly High: 1.1625

Previous Monthly Low: 1.1302

Previous Daily Fibonacci 38.2%: 1.1348

Previous Daily Fibonacci 61.8%: 1.1362

Previous Daily Pivot Point S1: 1.1312

Previous Daily Pivot Point S2: 1.1289

Previous Daily Pivot Point S3: 1.1253

Previous Daily Pivot Point R1: 1.137

Previous Daily Pivot Point R2: 1.1406

Previous Daily Pivot Point R3: 1.1429