Back

8 Aug 2018

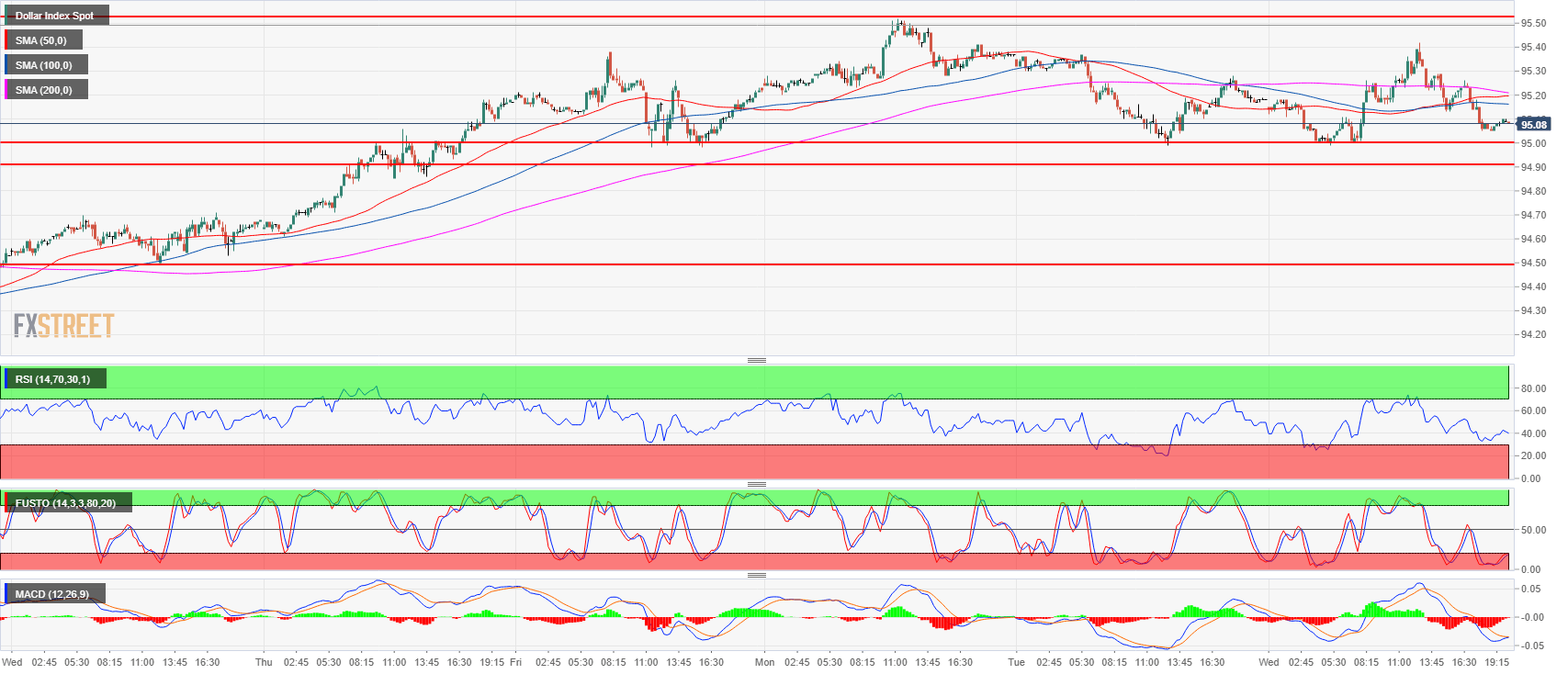

US Dollar Index: DXY holding above 95.00 level

- The US Dollar Index (DXY) has found some resistance at 95.52 on Monday and the market has been rotating lower ever since.

- Bears objective is to break below the 95.00 in order to target 94.91 July 27 high and then 94.61 August 2, low.

- On the flip side, bulls want to support the market and prevent the breakout below 95.00 from happening. If bulls can manage to break above Wednesday’s high at 95.42, some bears might give up as they could see it as the resumption of the bull trend.

DXY 15-minute chart

DXY daily chart

-636693563088774820.png)

Spot rate: 95.09

Relative change: -0.10%

High: 95.42

Low: 94.99

Trend: Bullish / Bearish pullback below 95.00

Resistance 1: 95.24 July 13 high

Resistance 2: 95.52 August 6 high

Resistance 3: 95.65 current 2018 high

Resistance 4: 96.00 figure

Resistance 5: 96.51 July 05, 2017 high

Support 1: 95.00 figure

Support 2: 94.91 July 27 high

Support 3: 94.61 August 2, low

Support 4: 94.49 August 1 low

Support 5: 94.08 July 26 swing low

Support 6: 93.71 July 9 swing low

Support 7: 92.24 May 14 low